Buying commercial property is a major step for any business - whether you're scaling up, relocating for better client access, or investing for the future. But the legal and financial steps involved can be complex, especially if it’s not something you do often.

This guide breaks down the commercial property purchase process into manageable, jargon-free stages, from initial planning to post-completion formalities. Whether you're a founder expanding your premises or a business leader managing growth, understanding each phase will help you stay in control and avoid costly surprises.

Caveat emptor – buyer beware – still very much applies. That’s why expert commercial property solicitors are essential from the start. Read on to see how the process unfolds and who we can support you at every stage.

Contents:

Pre-purchase stage

Before you decide to buy a commercial property, most businesses will have come to the conclusion that their current arrangements are not working. Whether it is location, space or function, they will have decided that they need to make changes to make their business work more effectively.

The buyer should go through an exercise to work out exactly what it is that their business needs for now and for the future and this should form part of the overall strategic planning. The buyer should also think about what the business’ investment goals are and what they need from the property.

It would be sensible to conduct some market research in the area in which the buyer hopes to buy (transport links, accessibility for employees, proximity to clients/customers). Look at various properties and types of property and compare them both in terms of usability and price then identify a shortlist.

Once the buyer has narrowed the choices down, they should engage a broker to help them work out the best way to finance the purchase. The broker will be able to explain the options and will help to obtain an offer in principle from a lender.

The Buyer should speak with their accountant about the best way to finance the deal from a tax and investment perspective.

Negotiation

If the buyer has a surveyor involved, they will help to come up with an offer strategy to secure the building the buyer wants. They will go through a period of negotiations on the purchase price and the terms of the purchase with the seller and their selling agents. This will result in the production of a memorandum of sale – this records all of the agreed terms including, importantly, the agreed sale price. Commercial property solicitors will use this to draft and check all of the legal paperwork.

Property due diligence

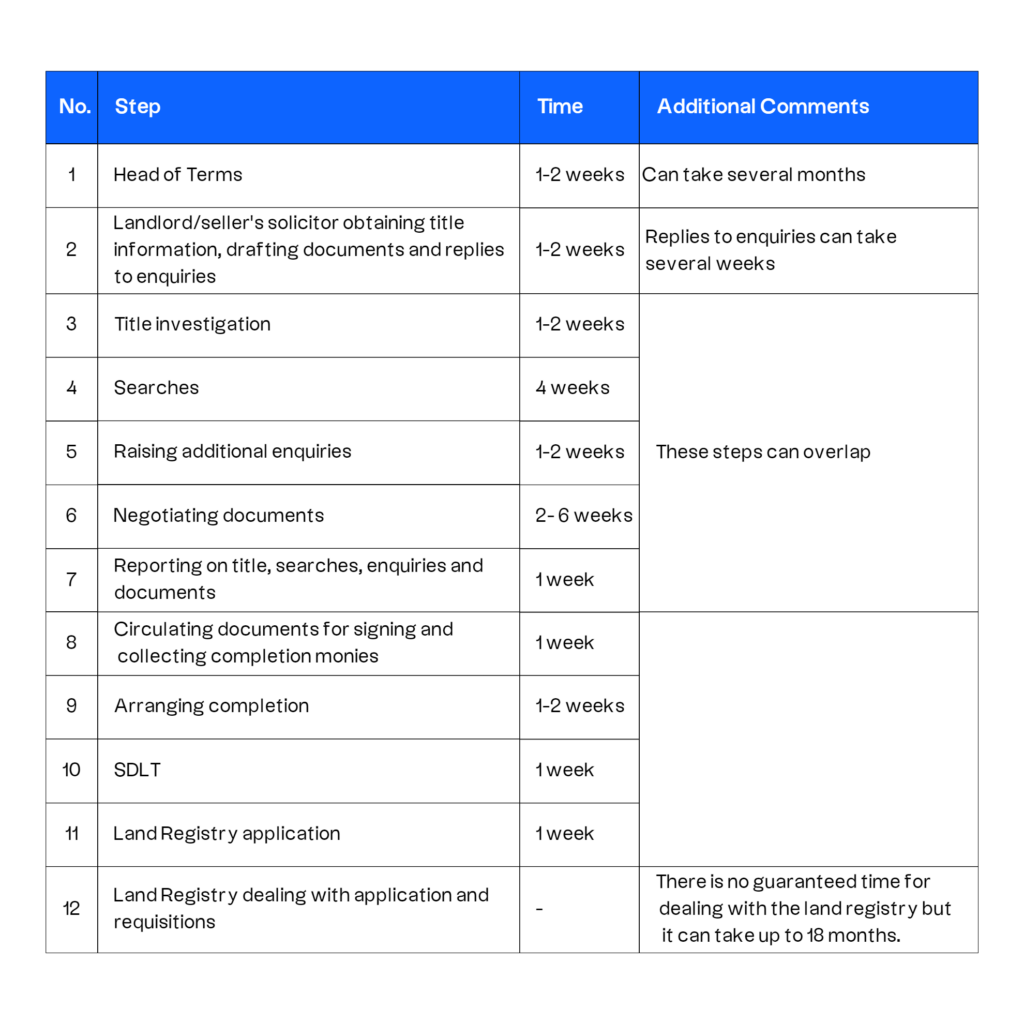

This is the point at which the buyer will need to get their advisory professionals involved. It is usually the most time consuming part of the process and can take a few weeks to complete.

When buying property, it is always advisable to obtain a thorough survey of the property to ensure that there are no structural issues or expensive items of maintenance needing to be carried out. Once you have completed your purchase; all of this will be the responsibility of the buyer to fix and to pay for. If relevant, the buyer could also consider carrying out an environmental search as they will take on the responsibility for cleaning up any past environmental problems on completion.

Searches

The buyer’s commercial property solicitor will obtain searches and will provide a report on their results. The usual searches include a Local Authority Search, a planning search, a desktop environmental search and a drainage and water search. Depending on where you are buying the property, others may be recommended such as coal mining in places like Sheffield or tin mining in Devon; your solicitor will be able to advise you. Your lender may also require specific searches. Searches are third party reports that provide information on the property and its locality that would be difficult to find elsewhere.

Some searches are returned to us within about 24 hours but others such as the drainage and water search and the local authority search do take longer and can take up to three weeks to be returned. The timescales vary depending on where it is being obtained from.

Title checks

The Seller’s solicitor will provide the buyer’s solicitor with copies of the property’s title. The buyer’s solicitor will work through this to check that the property has all of the rights it needs in order to function and will make sure that there are no rights granted to third parties that would prevent the buyer from using it for their intended use. They will of course report on this to the buyer.

CPSEs

In all commercial property transactions, the Seller/landlord must provide answers to the CPSEs: ‘Standard Commercial Property Enquiries’. There are several different forms of enquiries and what will be used will depend on what is going on at the property. In all instances they must reply to number one (or the shortform of these which is number seven). They may also supply answers to the others if, for example, there is a current tenancy in the property. The answers to CPSEs should be accompanied by copies of the documents and reports that are discussed in the answers. As you would expect, the buyer’s solicitor will go through these and report to the buyer on the findings.

Once the buyer’s solicitor has been through the searches, the title and the replies to CPSEs there may be a period of time where there is an exchange between solicitors with additional enquiries arising out of the initial information.

The aim of all of this is to find out as much about the property as possible so that there are no surprises.

Caveat Emptor: buyer beware! Unless you ask the right questions, the seller is under no obligation to tell you about the property.

Financing and legal considerations

Hopefully by this point the buyer has their formal mortgage offer in place and their solicitor will use the information they glean during the due diligence process to report to the bank if necessary.

The Buyer’s solicitor will also spend time working through the mortgage offer and will help to prepare any of the necessary paperwork to enable them to get the lending. For example, if the buyer is a limited company, the bank is likely to want the directors to enter into personal guarantees. The bank may also want to see the board minutes authorising the lending.

During this time the two solicitors will also be negotiating the terms of the contract and the transfer. You can read more on commercial property finance in our article.

Exchange of contracts

When the full due diligence exercise has been completed and the buyer is happy that they have the answers to all of their questions, it is time to sign the contract, the transfer and if relevant the mortgage deed.

Once both parties have the signed contract and returned it to their solicitor it will be time to exchange contracts.

The buyer will need to put their solicitor in funds for 10% of the purchase price and they will need to agree a completion date with their seller.

The solicitors will then call each other up and exchange contracts. At this point, the completion date is fixed, the seller is contractually obliged to sell and the buyer is contractually obliged to buy. The buyer’s solicitor will normally hold the 10% deposit on account for the seller.

Post-exchange

Between exchange and completion the seller will spend time making the property ready and making preparations to move out. The buyer should book their removals and make any other necessary arrangements to move their business.

The length of time between exchange and completion will vary but is often 7 to 10 days. This gives the parties time to make arrangements for moving and making the property ready for the new owner to take possession. During this time, the two solicitors will firm up arrangements for completion with each other.

The buyer’s solicitor will submit the certificate of title to the buyer’s bank so that they can prepare the drawdown of funds in time to complete. The buyer will also transfer any additional sums needed; for example the balance of the purchase price, money for stamp duty land tax and Land Registry fees.

Completion and post-purchase

On the day of completion, the buyer’s solicitor will send the purchase monies over to the seller’s solicitor. Once received, they will call each other and date the transfer. This is the point at which completion has taken place and the buyer is the new owner.

The seller’s solicitor will call the selling agents and authorise them to release the keys to the buyer.

The buyer’s solicitor will deal with the post completion formalities which usually involve:

- Applying to register the legal charge at Companies House (if the buyer is a limited company). This must be done within 21 days of completing the charge;

- Drafting and submitting the stamp duty land tax return and paying any stamp duty payable. There is a 14 day period during which this must be done before a penalty is incurred; and

- Applying to register the buyer’s ownership at the Land Registry. This should be done as soon as possible after dealing with points 1 and 2 above.

The buyer will need to spend time confirming the move to all of their suppliers and authorities such as business rates, water and electricity providers.

Conclusion

The stages in a property purchase are usually predictable and follow a prescribed formula. Whilst it can seem daunting at first, your commercial property solicitors will have done this many times before and will be in the perfect position to advise you and help you through the process.

The principle of Caveat Emptor means that the due diligence exercise is of paramount importance to ensure that you know exactly what it is that you are buying. Your solicitor will be an expert in asking the right questions; engage them early to make sure that your transaction runs as smoothly as possible.